🍎 What Apple Picking Teaches Us About Money: Finding Financial Balance

🍎 What Apple Picking Teaches Us About Money: Finding Financial Balance

Every fall, families head out to the orchard—baskets in hand—to pick apples. My family and I just went recently.

If you’ve ever gone, you know it’s not the cheapest way to get fruit. You could buy apples at the grocery store for far less, not to mention saving the gas, time, and effort. But that’s not why people go.

We go for the crisp air, the laughter, the chance to pause and make memories—maybe even to get lost in a corn maze or two.

Apple picking reminds us:

not everything about life, or money, has to be efficient to be worthwhile.

The Money Mindset Spectrum (Take the Quiz)

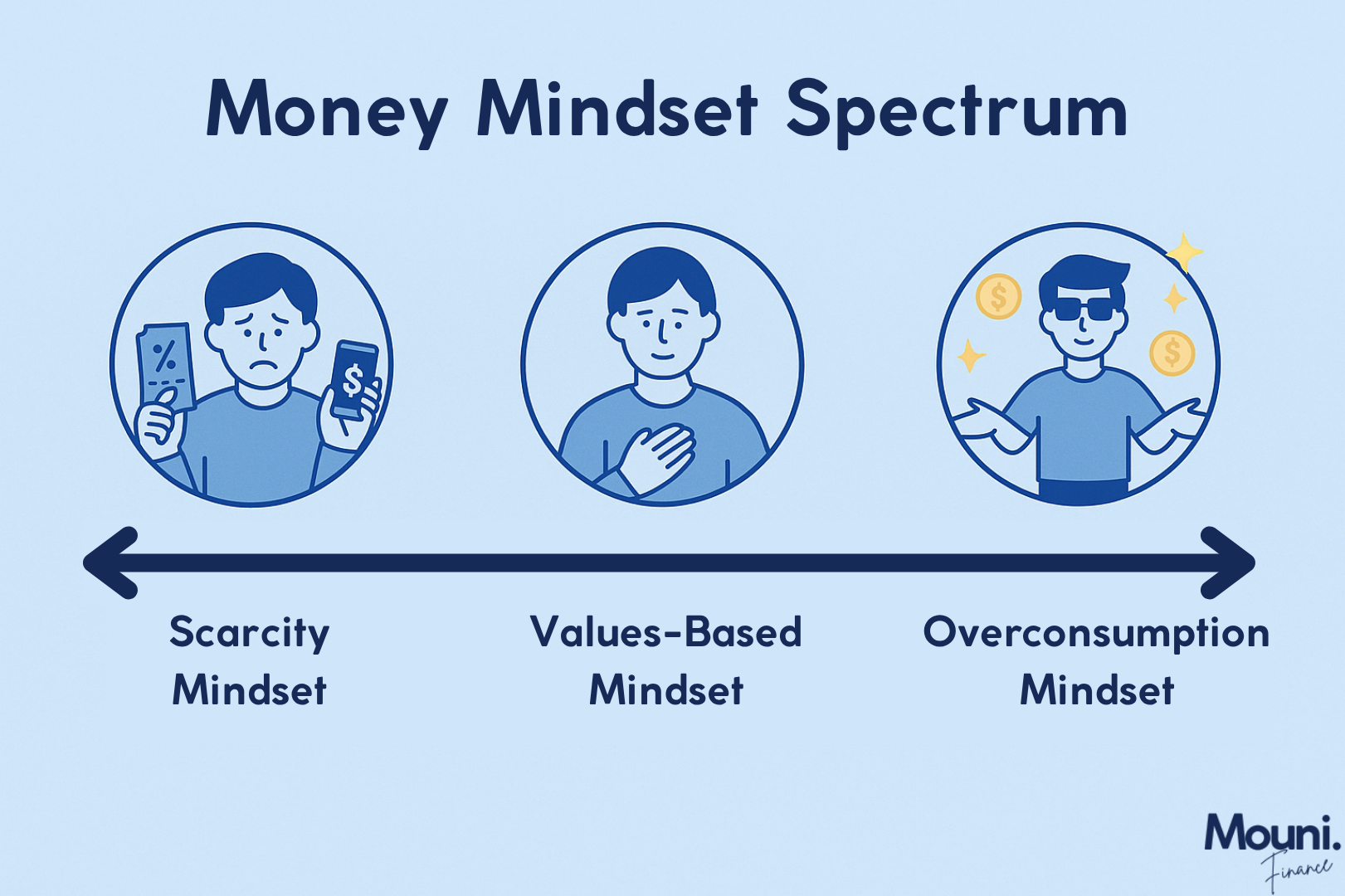

When it comes to money, most of us fall somewhere on a spectrum between two extremes:

😰 The Numbers-Centric Scarcity Mindset

Every penny tracked, every decision measured by the spreadsheet. Life feels secure—but often too rigid. Joy gets pushed aside for the sake of saving a dollar or two.

💸 The Experience-Centric Overconsumption Mindset

Spending flows freely toward experiences and fun. But budgets get ignored, savings fall behind, and paycheck-to-paycheck living becomes the norm.

Neither extreme works forever. Just like apple picking, what matters most is balance.

Why Balance Matters More Than Perfection

Apple picking is special because it’s

occasional. If it were the only way we got apples, it would lose its charm—and drain our wallets.

Money works the same way:

- Too much focus on efficiency, and you risk building wealth but missing the joy.

- Too much focus on

experience, and you risk living fully now but feeling

unsteady

later.

Balance means:

✔️ Knowing your numbers—income, expenses,

savings goals

✔️ Spending

intentionally

on what matters most

✔️ Having systems that keep you secure so joy feels guilt-free

Examples of Balance in Action

- Saying yes to a

$20 coffee date with a friend because connection matters more than saving a few dollars.

- Choosing to put

$50 into savings instead of splurging on an impulse Amazon Prime Day deal.

- Taking the family apple picking once a year, but buying everyday fruit at your local grocer.

Balance is less about “right” or “wrong” choices and more about whether your choices reflect your values while keeping your foundation stable.

The Psychology of Balance: Why It’s Hard

If you’ve ever felt like you swing between overspending and over-saving, you’re not alone. There are real psychological forces at play:

- Scarcity mindset (Poverty Mindset): Fear of not having enough can make us hoard, delay joy, or feel guilt when we spend.

- Present bias: Our brains naturally favor immediate rewards, which makes overspending on fun easier than saving for future goals.

- Comparison trap: Seeing others’ highlight reels (vacations, homes, purchases) makes us feel “behind,” even when our plan is working.

That’s why building balance isn’t just about math—it’s also about mindset.

The Mouni Finance Approach: Values Before Perfection

At Mouni Finance, we focus on clarity over complexity and values before perfection. Money isn’t just numbers—it’s a tool to build a life that feels calm, confident, and aligned with what matters most.

Next time you’re tempted to cut out a joy (like apple picking) or overspend without thought, pause and ask:

👉 Does this choice reflect my values?

👉 Do I have systems in place to keep my finances stable?

If you can answer yes to both, you’re on the right track.

Rebalancing: The Ongoing Work of Financial Health

Many people tell me:

“I keep getting off balance. I just can’t seem to stay consistent. I must be broken.”

You’re not broken. This is life.

Think about physical health: when we’re consistent with exercise, rest, and nutrition, we feel strong. But when routines slip, our energy drops, and it’s easy to compare our low points to someone else’s high points.

Money is the same.

You can’t just set the sails on your financial ship once and expect smooth sailing forever. Life brings shifting winds and unexpected storms. You have to adjust, reset, and sometimes even chart a new course.

Personally, I revisit and rebalance my financial habits several times a year to stay aligned with my values.

And here’s the truth: deterioration is the default. If you don’t actively maintain your financial systems, things drift. That’s not a sign of failure—it’s the price of living in a world where entropy is real.

That’s why intentional rebalancing matters.

Final Thought: You Don’t Need Shame, You Need a Reset

If you’re feeling off track, the answer isn’t to beat yourself up. It’s to pause, reset, and realign with what matters most.

Like apple picking, money is about more than efficiency. It’s about choosing joy, building stability, and creating a life that feels as refreshing as a crisp fall day.

Your Next Step

Want help creating a money plan that blends structure with freedom?

👉

Book a free 15-minute exploration call with me, and let’s chart your path together.

Or, start small on your own:

- Track your expenses for one week.

- Highlight the moments of joy and the moments of “waste.”

- Adjust one thing to bring more balance into your next week.

Until next time,