Maximize Your Roth IRA and HSA – The Ultimate Tax-Perks Combo

When it comes to building wealth, it’s not just about how much you make or even how much you save – it’s about how much you get to keep. Taxes can erode a big chunk of your investment gains over time. That’s why the savviest investors make it a priority to funnel their money into tax-advantaged accounts. In this post, we’ll do a deep dive into two of the most powerful tax-advantaged tools available: the Roth IRA and the Health Savings Account (HSA). These are the accounts that can give you outsized “tax perks” on your road to financial independence – essentially, letting you legally avoid certain taxes so your money grows faster.

This is Step 7 of the Mouni Money Map (Max Tax Perks), but even if you’re new here, don’t worry – the concepts we cover today stand on their own as game-changing strategies for your finances. By the end, you’ll understand why financial experts from J.L. Collins to Ramit Sethi sing the praises of Roth IRAs and HSAs, and how you can implement these in your own life for maximum benefit.

What Is a Roth IRA (and Why Should You Care)?

A Roth IRA is a type of individual retirement account that you fund with after-tax dollars. Unlike a Traditional IRA (where you’d get a tax deduction now and pay taxes later on withdrawals), a Roth IRA flips the script. With a Roth:

- You pay taxes now, on the money you contribute (no upfront deduction).

- Your contributions and investment earnings grow tax-free inside the account.

- You can withdraw money tax-free in retirement, including all those earnings, as long as you follow the rules (generally, keep the account at least 5 years and be 59½+ for the earnings)

In other words, you contribute after-tax money today and never pay tax on it again – not on dividends, not on capital gains, not on the withdrawals in retirement. If that sounds like a sweet deal, it absolutely is. As one advisor put it: a 7% annual return in a Traditional IRA might feel more like 5-6% after you pay taxes in retirement, but a 7% return in a Roth IRA is a full 7% to you, because Uncle Sam’s cut is zero.

Let’s illustrate why the Roth IRA is so beloved. Say you contribute $7,000 a year (the current annual limit for 2025, for someone under age 50) to a Roth IRA from age 25 to 55 – 30 years of contributions. If we assume an ~8-9% average annual investment return (a reasonable long-term stock-heavy portfolio return), your Roth IRA could grow to around $900,000 by age 55. By retirement a decade later, it could easily be over $1 million. And all of that can be withdrawn tax-free. Every penny of gains – tens or hundreds of thousands of dollars – stays in your pocket rather than going to taxes.

Now compare: had you invested that money in a regular taxable brokerage account, you’d owe capital gains tax over the years and on withdrawals, significantly cutting into your net return. Or if it were in a Traditional IRA/401k, you’d pay income taxes on withdrawals. The Roth IRA clearly shines if you value

tax-free income in retirement.

Key Benefits of the Roth IRA:

- Tax-Free Growth & Withdrawals: The headline benefit – once your money’s in a Roth, all the growth is untaxed, and qualifying withdrawals in retirement are untaxed too. This provides certainty; you know whatever amount is in your Roth is 100% yours.

- No RMDs: Roth IRAs are not subject to Required Minimum Distributions in the owner’s lifetime. You’re never forced to pull money out if you don’t need or want to. It can keep growing tax-free longer. (Traditional IRAs/401ks, by contrast, make you start withdrawing at a certain age, but Roths don’t.)

- Flexibility with Contributions: You can withdraw your original contributions at any time, penalty- and tax-free. (Only the earnings are locked up until 59½.) This means if you really needed some of the money you put in, you could access it. While it’s best to leave it in for retirement, this flexibility adds a layer of safety.

- Estate Planning Bonus: Roth IRA assets pass to heirs income-tax-free. Heirs will have to take distributions (under current rules) but those distributions are still tax-free. This makes the Roth a potentially great vehicle for intergenerational wealth transfer.

Who Should Use a Roth IRA? In general, Roth IRAs make a ton of sense if you (a) expect your income or tax rates to be higher in the future, (b) are early in your career (so your current tax rate is relatively low), or simply (c) want tax diversification.

Even if you think your tax rate at retirement might be similar to now, having a bucket of tax-free money gives you flexibility (you can draw from it in high-tax years, etc.). For many young professionals, contributing to a Roth while in, say, the 22% tax bracket and then having tax-free money in retirement (when tax rates could be higher and when things like Social Security could push you into higher brackets) is a smart play.

It’s no surprise, then, that Roth IRA funding appears as a priority in many “financial order of operations” plans. Ramit Sethi, for example, places opening and investing in a Roth IRA as a foundational step once you’ve got your 401k match and debts in order. The Money Guy experts actually list “Max out Roth IRA” as Step 5 in their nine-step Financial Order of Operations, right alongside the HSA. It’s considered one of the first big “optimization” moves after you handle the basics, thanks to its powerful tax-free growth.

Income Limits and the Backdoor Roth: One catch with Roth IRAs is that not everyone can contribute directly – there are income limits. In 2025, for instance, the ability to contribute to a Roth IRA phases out and stops at a modified adjusted gross income of about $150k–$165k for single filers and $236k–$246k for joint filers. But fear not if you’re above that range: you can use a strategy known as the Backdoor Roth IRA. This isn’t a sketchy loophole; it’s an IRS-approved method.

Basically, you contribute to a Traditional IRA (which has no income limit) – typically a nondeductible contribution – and then convert that money to a Roth IRA. Since you already paid tax on the contribution (it was nondeductible), the conversion is mostly tax-free. This lets high earners bypass the Roth income cap. If you’re a high earner, the backdoor Roth is absolutely worth looking into so you don’t miss out on Roth benefits. (A quick note: if you have other Traditional IRA funds, the conversion can get more complex due to pro-rata rules – it’s wise to read up or consult a pro in that case.)

Maximizing Your Roth IRA: To get the most out of a Roth IRA, you’ll want to contribute the maximum each year if possible (remember, it’s $7,000 in 2025 for under 50, and $7,000 + $1,000 catch-up if 50 or older). Automating your contributions can help – for example, set a monthly transfer of $583 to your Roth account, so you hit $7k over 12 months. And crucially, invest the money in your Roth according to your long-term strategy. A Roth IRA is an investing vehicle, not an investment itself – holding 100% cash in a Roth is a missed opportunity. Many experts suggest a diversified stock index fund for growth if it aligns with your risk tolerance, given the long time horizon for retirement funds.

Understand Roth vs. Traditional IRAs

One question matters most:

Do you want to pay taxes now (Roth) or later (Traditional)?

How to Decide

✅ Choose Roth if:

- You expect to be in a higher tax bracket later (common for young investors)

- You love the idea of tax-free growth (Yes, really. $0 taxes on withdrawals!)

- You might need to access your contributions early (Roth allows this penalty-free)

✅ Choose Traditional if:

- You expect to be in a lower tax bracket in retirement

- You need tax relief today (deductions now = lower taxable income).

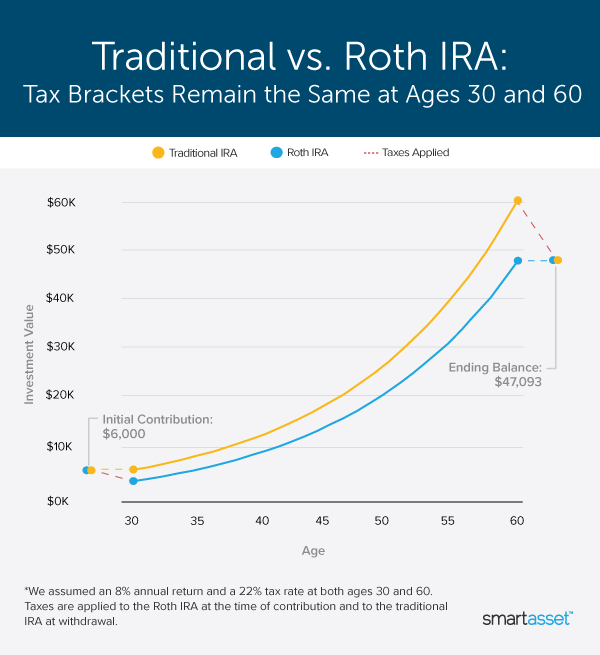

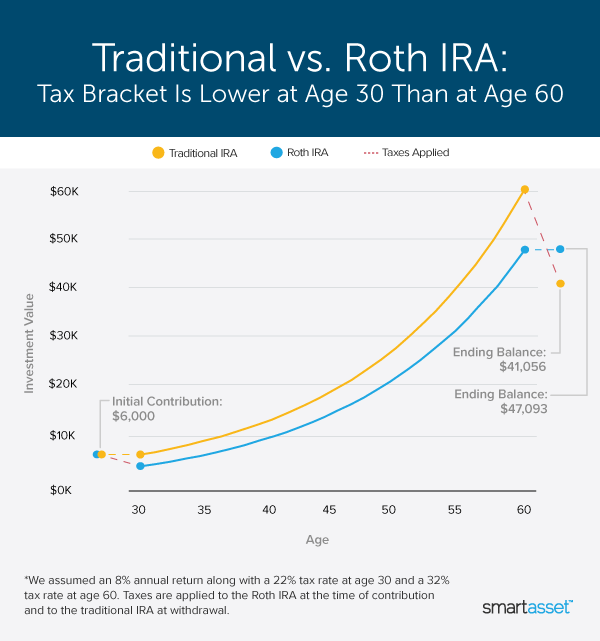

Below are graphics that show how a Roth IRA and a Traditional IRA compare with an initial contribution of $6,000. Notice how the blue line (Roth IRA) starts slightly lower than the yellow line (Traditional IRA). That is because you pay taxes on your $6,000 upfront before you invest in a Roth, while with a Traditional IRA you invest the full $6,000 pre-tax.

Over time, both accounts grow at the same rate. If your tax bracket stays exactly the same when you withdraw at age 59 and a half, both accounts would give you the same ending balance. The Traditional IRA looks larger before taxes, but once taxes are applied at withdrawal, the balance matches the Roth IRA.

The key difference is what you expect your future tax rate to be. For many people, especially younger investors, your tax bracket may be higher when you retire than it is today. That makes the Roth IRA so powerful — you pay taxes now, grow your money tax-free, and keep every dollar of your growth later. Check out the graphic below to see this in action.

Rule of thumb: If your tax bracket is 24% or lower today, a Roth IRA is usually your best choice. If your tax bracket is 30% or higher, it often makes sense to choose a pre-tax option like a Traditional IRA or 401(k).Many people use both to balance their tax savings now and later.

I know this can feel like a lot to compare. If you feel stuck, start with a Roth. Or reach out to me — I am always happy to help you figure out which option makes sense for you. The most important step is getting started. (Graphics source article).

What Is an HSA (Health Savings Account)?

Next up is the Health Savings Account (HSA) – which might sound like it’s only about medical bills, but it has a surprise superpower: it can double as a phenomenal retirement investment account. An HSA is available to individuals or families enrolled in a high-deductible health plan (HDHP) – generally health insurance plans with a higher deductible (and lower premiums). The idea of an HSA is to let you set aside money for out-of-pocket medical expenses. But what sets the HSA apart is its triple tax advantage, which is unique among all investment accounts.

Here’s how an HSA works, in brief:

- You contribute money to your HSA pre-tax. If it’s through your employer payroll, it comes out before income tax (and usually before Social Security/Medicare tax too). If you contribute on your own, you can deduct it from your taxable income. Either way, you don’t pay tax on the money going in.

- That money can sit in a savings account or, often, be invested in mutual funds, etc., just like in an IRA. Any interest, dividends, or growth in the account is tax-free – you don’t pay taxes on those earnings each year.

- When you use the money, as long as it’s for qualified medical expenses, the withdrawal is tax-free. You never pay tax on that money, ever, if it goes toward medical costs. That’s federal tax-free, and in most cases state tax-free too.

That’s the magical “triple tax-free” combo: no tax going in, no tax while it grows, no tax coming out (for eligible expenses). For comparison, a Traditional 401k/IRA is tax-free in and grows tax-free, but taxed on withdrawal; a Roth IRA is taxed in, grows tax-free, and tax-free out – so that’s double. The HSA is the only one that can be triple tax-free. It’s like the unicorn of investment accounts.

HSA Contribution Limits and Basics: For 2025, HSA contribution limits are $4,300 for individuals and $8,550 for families (with an extra $1,000 catch-up allowed if you’re 55 or older). Unlike a Flexible Spending Account (FSA) which some might confuse it with, an HSA is not “use it or lose it.”

Your HSA balance rolls over indefinitely. You could contribute this year, not spend it, and have it available decades later. The money in an HSA is always yours, even if you change jobs or insurance. You do need to be enrolled in an HSA-eligible HDHP to contribute for that year, but once the money is in there, it stays until used.

Using the HSA as a Stealth Wealth Account: Many financial independence enthusiasts treat their HSA as a second or supplemental retirement account. Here’s the strategy that J.L. Collins and others recommend: Contribute the max to your HSA each year, invest that money in a broad index fund (or other growth investment), and pay your actual medical expenses out-of-pocket from your regular checking account if you can. By doing this, you allow the HSA to grow untouched. Meanwhile, you save every receipt for any medical expenses you did pay out-of-pocket.

Why save receipts? Because there’s no time limit on reimbursing yourself from an HSA for a qualified expense as long as you incurred that expense after you opened the HSA. You could, in 2035, pull out a stack of receipts from 2025, 2026, 2027 medical expenses, add them up, and withdraw that exact amount from your HSA tax-free at any time. You don’t even have to withdraw in the same year you had the expense. This effectively turns the HSA into a back-loaded tax-free fund: you let it grow, and maybe 20 years later you reimburse yourself for a bunch of old medical costs (tax-free), which puts cash in your pocket when you might really need it.

And if you end up not needing to reimburse yourself for those expenses because you’re flush with other cash? Even better – you let the HSA ride longer. By age 65, the rules loosen: you can withdraw HSA funds for any reason without a penalty (you’d just pay normal income tax if not for medical, similar to a Traditional IRA). At that point, if you’ve never touched your HSA, you essentially have a Traditional IRA (taxed on withdrawal) but remember, you got a tax break on all those contributions and decades of tax-free growth. It’s almost like a “double-dip” retirement account. You get the upfront deduction (like a traditional IRA) and if used for medical or via reimbursement, you get the tax-free withdrawal (like a Roth). Truly the best of both.

Prioritizing the HSA: Now, an HSA is only available if you have an eligible health plan. It’s not something everyone can open freely like an IRA. So there’s a bit of a conditional here: if you’re eligible for an HSA and you can afford to, you should seriously consider maxing it out. Many advisors put the HSA on par with Roth IRA in terms of priority. It’s often overlooked, but once you know, you can’t unsee the advantages.

Common HSA Questions or Misconceptions:

- “What if I have medical expenses now? Isn’t the HSA for that?” – Yes, if you have medical bills and need the money, by all means use your HSA funds tax-free to cover them. That’s what it’s for. But if you can cover an expense from other savings without hardship, consider doing so and let the HSA money grow. Think of the HSA as a long-term wealth account that you can dip into for health costs if needed, but it doesn’t have to be emptied each year. There’s a big opportunity cost to spending HSA dollars now when they could be invested and growing for later.

- “I’m healthy and don’t have a lot of medical expenses. Is an HSA still worth it?” – Absolutely. In fact, that’s the best case: you max it out, invest it, and don’t touch it for many years. You’ll inevitably have health costs at some point (everyone does, especially as we age). Having a big tax-free pot to draw from at that time is fantastic. And if somehow you never need it for medical, after 65 it’s basically an extra retirement fund.

- “My employer offers an FSA, is that the same?” – No, Flexible Spending Accounts (FSAs) are different. FSAs generally have lower limits and are use-it-or-lose-it each year (aside from a small carryover in some cases). FSAs don’t invest in the market. An HSA is far superior as a long-term account because the money can roll over and grow. You can’t personally choose to have an HSA unless your health insurance qualifies, whereas many employers offer FSAs regardless of plan – but again, FSAs don’t carry over the bulk of funds year to year. Don’t confuse the two. Use my side-by-side comparison resource to see the difference.

- “What can HSA money be used for?” – Qualified medical expenses is broad: it covers things like deductibles, co-pays, prescriptions, many over-the-counter meds, vision and dental care, etc. In retirement, HSA funds can also be used to pay Medicare premiums or other healthcare costs. Basically, any health-related expense that you’d normally pay out-of-pocket can be paid from HSA funds tax-free. The IRS has a list of qualified expenses. If you spend HSA money on non-qualified expenses before age 65, there’s a 20% penalty plus taxes – so don’t do that. After 65, as mentioned, you can withdraw for anything (penalty-free, just pay taxes if not a medical expense).

How Roth IRAs and HSAs Work Together in a Financial Plan

You might be thinking: should I prioritize one over the other? The truth is, if you’re eligible for both, both are amazing and serve slightly different purposes. The Roth IRA is primarily for general retirement spending – covering your living expenses, fun, travel, what have you, when you stop working. The HSA is earmarked for health expenses (with the flexibility to act like a traditional retirement account after 65).

In practice, many people in the financial independence community aim to max both each year. It’s no coincidence that together the Roth IRA and HSA contribution limits often sum up to a nice chunk (about $7k + $4k = $11k for a single person in recent years, more if family HSA). These become core annual goals in one’s budget. If you’re following a roadmap like our Mouni Money Map or others, you’ll typically address these after you’ve done things like grabbing employer 401k matches, paid off toxic debt, and built an emergency fund. Once those fundamentals are set, funneling money into Roth and HSA is often the next move before investing in taxable brokerage accounts or before maxing out every last dollar of the 401k. Why? Because of that tax-free growth advantage – you want as much of your money growing tax-free as possible.

Think of it this way: If you have an extra $1,000 to invest, would you rather put it in an account where the earnings might get taxed each year (like a brokerage) or at withdrawal (traditional IRA), or one where it will never be taxed again (Roth or HSA for medical)? The latter wins assuming no other constraints. That’s why we “max the tax perks” here at step 7 – it’s about optimizing the dollars after you’ve handled the basics.

The interplay also offers future flexibility. Financial planners talk about tax diversification. When you retire, it’s incredibly useful to have a mix of tax-deferred money (traditional 401k/IRA), tax-free money (Roth IRA/HSA), and perhaps some after-tax money (brokerage). This mix lets you choose which to withdraw from to manage your tax bracket in retirement. For instance, if you’re having a year with a lot of taxable income, you can lean on Roth or HSA withdrawals (tax-free) for cash flow. Or if you need a large sum (buying a car, etc.), maybe you take from Roth to avoid a tax hit.

It’s like having multiple levers to pull. People who only save in pre-tax accounts sometimes find themselves facing big tax bills later because all their retirement income is taxable; by including Roth and HSA in your saving strategy, you’re giving yourself tax-free sources to draw from as well. One Money Guy Show discussion highlighted that their high-net-worth clients who have built all three buckets (taxable, tax-deferred, tax-free) can end up in very low tax brackets in retirement despite high spending, simply by “gamifying where their dollars come from” each year. That’s the endgame benefit of doing this now.

Current Limits and Eligibility at a Glance (2025)

- Roth IRA: Contribute up to $7,000 per year (if under 50; $8,000 if 50+). Income eligibility: single filers can contribute the full amount if MAGI (Modified Adjusted Gross Income) less than ~$150k (phase-out up to ~$165k), married joint filers if MAGI less than ~$236k (phase-out up to ~$246k). Above those ranges, use a backdoor Roth method. You need earned income at least equal to your contribution. Contributions deadline is tax day of the following year.

- HSA: Contribute up to $4,300 (self-only coverage) or $8,550 (family coverage) for the year. If you’re 55+, you can put in an extra $1k. To be eligible, you must be enrolled in a high-deductible health plan (HDHP) and not have other first-dollar health coverage (no traditional plan, not enrolled in Medicare, etc.). Your HDHP must have a deductible of at least $1,650 (single) / $3,300 (family) in 2025, among other IRS requirements. You can contribute for any months of the year you were eligible. If your coverage starts or ends mid-year, there are partial year rules to consider.

(Note: These limits often adjust annually for inflation. Always double-check the latest numbers for the year you’re contributing. The concepts remain the same.)

Getting Started (or Continuing) with Roth and HSA

1. If you haven’t opened these accounts yet: Take action and open them! A Roth IRA can be opened with any brokerage – it’s usually straightforward online. An HSA might be opened through your employer’s recommended provider if you have one, or you can choose an HSA provider (some banks, credit unions, and brokers offer them – look for low fees and good investment options).

2. Automate contributions: Treat your Roth IRA contribution like a recurring bill to yourself. The consistency will make maxing it much easier. For an HSA, if possible, contribute via payroll deduction (many employers allow this), which also saves you FICA tax in addition to income tax – a nice little extra 7.65% benefit. If not, set up a monthly auto-transfer to your HSA.

3. Invest according to your plan: Within the Roth, since this is long-term money, many people opt for a diversified stock fund or a target-date retirement fund. In an HSA, many providers require you keep a portion in cash (to cover near-term medical bills) and let you invest the rest once your balance exceeds a threshold (often $1,000 or $2,000). Choose investments for the HSA as you would for an IRA – something low-cost and growth-oriented for the long run (unless you plan to use the HSA funds very frequently for current expenses, in which case keeping more in cash is prudent).

4. Monitor and adjust: Each year, re-evaluate. If you get a raise, consider increasing any automated contributions. If limits go up, try to step up your contributions to match. Also, if your life situation changes – e.g., you switch to a non-HDHP health plan (thus losing HSA eligibility) – adjust your strategy. Or if your income jumps over the Roth limit, be ready to do a backdoor Roth process (it’s still worth contributing via that method in most cases, to retain the tax-free growth opportunity).

5. Don’t neglect other goals: Maxing Roth and HSA is powerful, but always in balance with your overall plan. For example, if your employer 401k has a match or other benefits, you’d typically ensure you capture those too (likely you did in earlier “steps”). And maintain your emergency fund. Think of Roth/HSA contributions as part of your “wealth optimization” phase – very important, but built on the foundation of good financial habits and safety nets.

Conclusion: Small Tax Perks Now, Huge Benefits Later

Maximizing your Roth IRA and HSA isn’t just some nerdy tax move (though, let’s face it, we’ve been delightfully nerdy in this post) – it’s a practical way to accelerate your journey to financial freedom. By being strategic about where you put your money, you’re ensuring that more of it goes toward your future goals and less gets siphoned off in taxes. It’s about working smarter, not just harder. After all, every dollar saved in taxes is a dollar that can earn more investment returns for you.

The path to wealth doesn’t have to be about deprivation – it can be about making wise decisions that set you up for long-term success. Using Roth IRAs and HSAs to the max is one of those wise decisions. You’re leveraging the tools that the government created for you to use. Think about that: these accounts exist because policymakers wanted to encourage Americans to save for retirement and healthcare. The “reward” for using them is these tax breaks. So take your reward – you’ve earned it by planning ahead.

If all of this feels a bit much, remember you don’t have to implement everything perfectly overnight. Start with one: if you’ve never had a Roth IRA, open one and begin contributing what you can. If you have a high-deductible health plan but never opened the HSA, log into your benefits portal and set up a small contribution. You can always increase these as you get more comfortable. The important thing is to begin. Once you see the balances growing and realize come tax time that you owe less because you contributed, it becomes almost addictive (in a good way!) to maximize these accounts.

By maximizing your tax perks through Roth IRAs and HSAs, you’re not gaming the system – you’re playing it exactly as intended, to your advantage. You’re securing tax-free income for your later years and buffering yourself against healthcare costs. You’re also joining the ranks of those who understand that true financial optimization is about both offense (earning, investing) and defense (tax efficiency, cost control). With Step 7 of our money map completed, you’ve put in place the defensive “armor” that will protect more of your money as it grows.

Here’s to a future where more of your investment fruits stay on your tree for you to enjoy 🍎 – and less gets picked off by the tax man. Your older self is already smiling knowing that a chunk of their retirement income will be coming out 100% tax-free. Now that’s a perk worth striving for!

Have questions or want to share your experience with Roths or HSAs? Drop a comment or reach out – I’d love to hear how you’re using these accounts to better your financial life. And if you found this deep dive useful, consider sharing it with a friend or family member who could benefit.

Empowering others with financial knowledge is itself a great gift – and it helps build a community of people making smart money moves together. Here’s to maxing those tax perks and making every dollar count!